Over the past ten years, the Canadian real estate market has seen unprecedented shifts. Home prices have been on a consistent upward climb, while interest rates remained moderately steady until 2021 when they plunged to the lowest in Canadian history, only to subsequently spike to a 15-year high.

These changes have significantly impacted the cost of mortgages, and with income growth struggling to keep pace, there is a noticeable discrepancy between mortgage payments and salaries, and as a result, many homebuyers are now reevaluating their real estate goals.

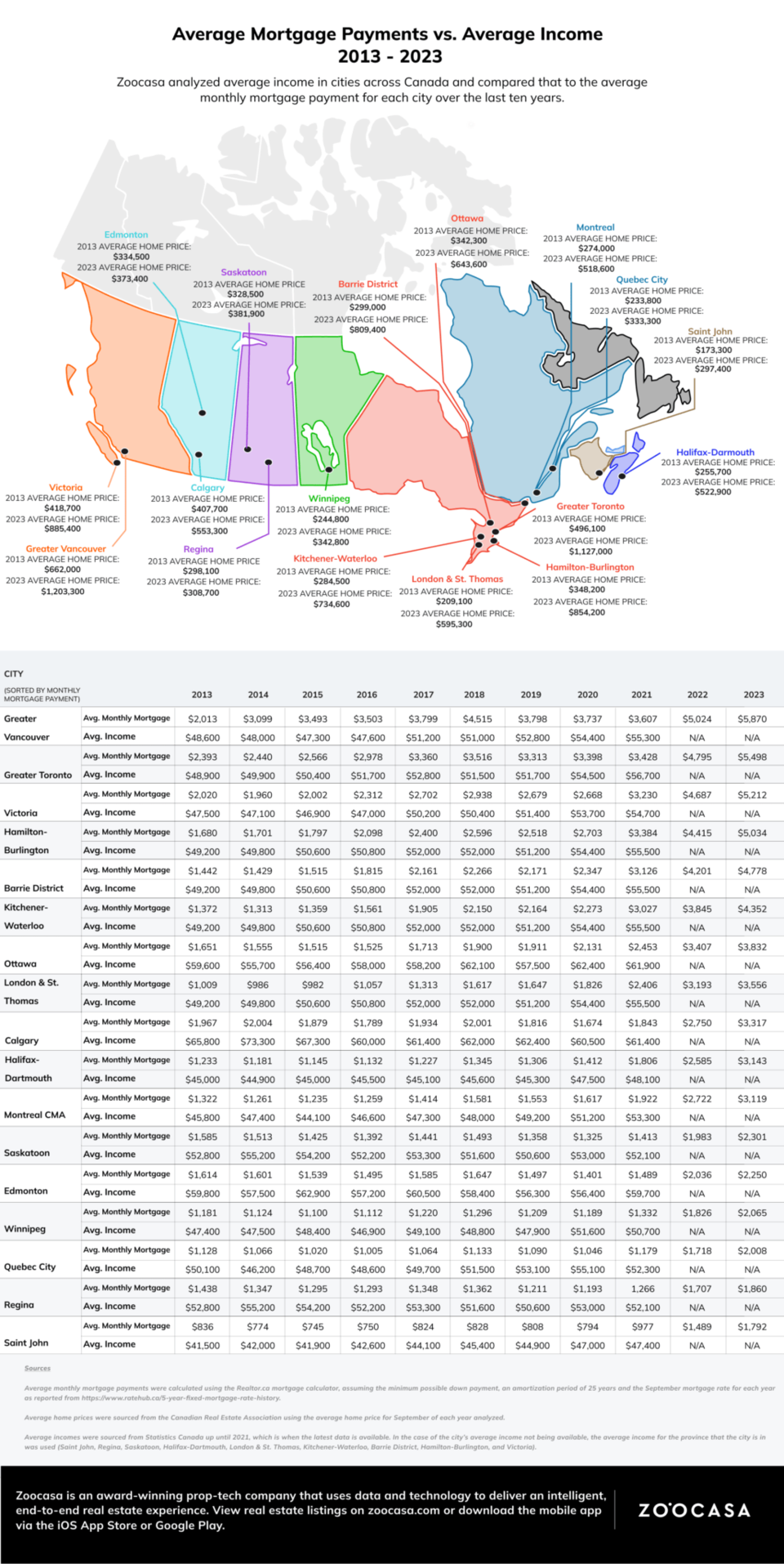

In a new report, Zoocasa has revealed just how quickly the cost of mortgages has risen compared to incomes in various Canadian cities over the past ten years. The key takeaway? Over the past decade, monthly mortgage payments have surged by over 100% in ten of the analyzed cities, while incomes rose by just 16% or less.

To gain insights into this growing disparity between mortgage costs and incomes, Zoocasa analyzed data from September 2013 to September 2023 in 17 Canadian cities and calculated the average mortgage payment for each year on an average-priced home. Zoocasa said this was assuming the minimum possible down payment, an amortization period of 25 years, and using the 5-year fixed rate in September of each year analyzed, with rates sourced from Ratehub.com.

Mortgage Payments vs. Income Growth:

According to the report, over the last decade, average monthly mortgage payments increased in every city analyzed. In the majority of cities, these payments have risen by more than $1,000, with four cities experiencing increases of over $3,000 since 2013.

Hamilton-Burlington and Barrie District stand out with the largest increases. In 2013, the average monthly mortgage payment in Hamilton-Burlington was just $1,680, but by 2023, it had risen to $5,034, an increase of $3,354. Barrie District followed a similar path, with the average monthly mortgage payment rising from $1,442 in 2013 to $4,778 in 2023. Zoocasa says these steep increases can be largely attributed to the average home prices in both regions, which increased by over $500,000 during this period. While wages did see some growth in these cities, it was far from sufficient to match the soaring mortgage payments.

Victoria and Greater Toronto were not far behind, experiencing mortgage payment increases of more than $3,000, translating to 158% and 129.8% increases, respectively. However, despite income growth, this equated to just 15.2% for Victoria and 16% for Toronto. The gap between income and mortgage payment increases is evident.

Cities Defying the Trend:

Surprisingly, three cities managed to keep their mortgage payment increases below 50%: Saskatoon (45.2%), Edmonton (39.4%), and Regina (29.4%). These cities also saw relatively modest increases in home prices, which contributed to the more manageable mortgage payment increases. In fact, Regina's monthly mortgage payments only inched up by $422 in the last ten years. However, Zoocasa pointed out that wages in Regina actually fell, with the average income in 2013 at $52,800 and in 2021, the last time data was available, declined to $52,100.

Calgary, on the other hand, experienced a decrease in average income, dropping from $65,800 in 2013 to $61,400 in 2021. However, compared to other metropolitan cities, home prices and monthly mortgage payments grew moderately less.

Even in Saint John, considered one of the most affordable cities in Canada, home prices increased by $124,000, leading to nearly a $1,000 increase in monthly mortgage payments. Saint John also had the lowest average income among the cities analyzed at $47,400 in 2021, just behind Halifax-Dartmouth at $48,100.

As the real estate landscape in Canada continues to evolve, the growing disparity between mortgage payments and income is becoming increasingly apparent.

While some cities have managed to keep this gap relatively narrow, others are facing steep challenges, and it's essential for prospective homebuyers to carefully consider their financial circumstances in this changing environment.