For many Canadians, owning a single-family home represents more than just a financial investment. It's about creating a space for family, pets, and cherished memories. However, achieving this dream can feel daunting, especially given the current real estate landscape.

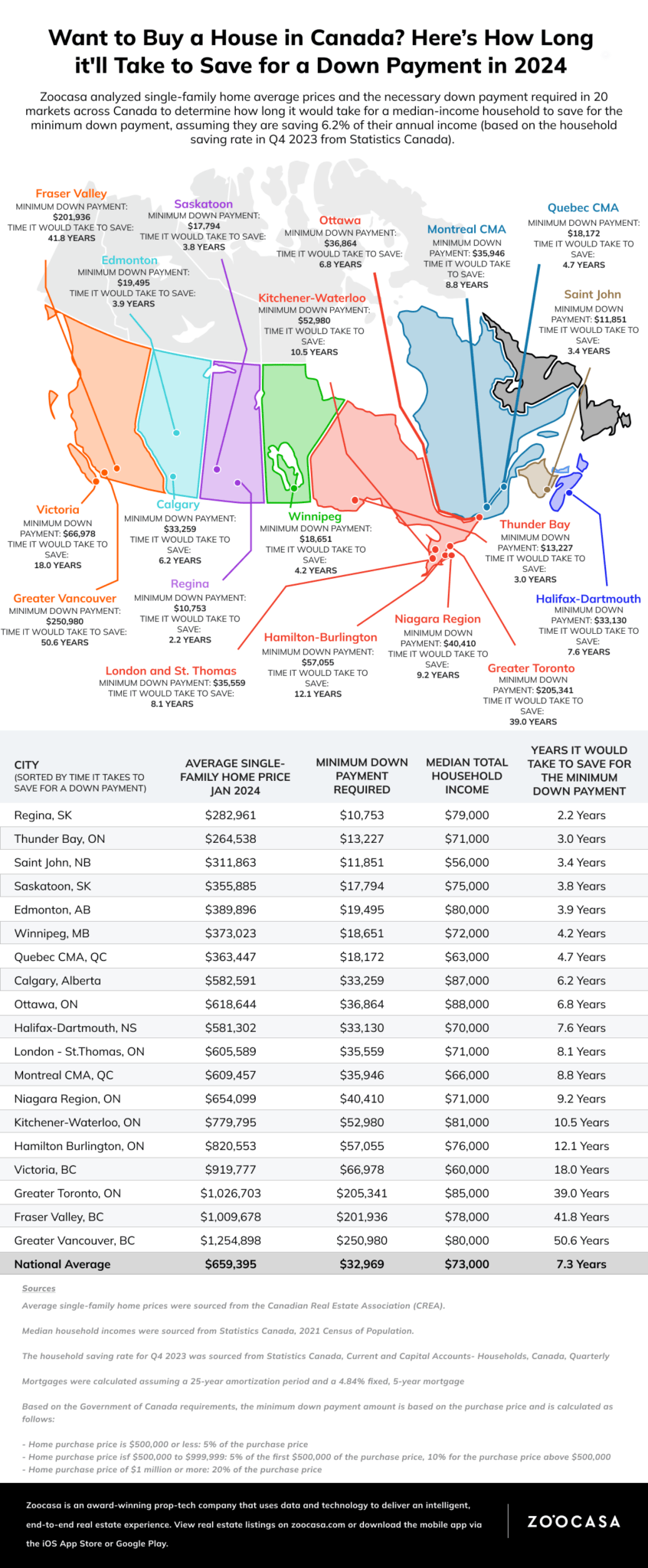

In a recent study conducted by Zoocasa, housing markets in 20 major Canadian cities were analyzed to determine the time it takes for a median-income household to save for a down payment on a single-family home. The results provide valuable insights into the affordability of homeownership across the country.

Regina and Thunder Bay: Affordable Options

In Regina, homeownership dreams can become a reality faster than anywhere else in Canada. With just two years and two months of saving, a household earning the median income may be able to secure the minimum down payment for an average single-family home priced at $282,961.

Similarly, Thunder Bay boasts some of the most affordable homes in the nation, with an average price of just $264,538. By setting aside around 6% of your salary, you could be ready to make the minimum down payment in three years.

Saving for a Home in Less Than Five Years

Saint John emerges as the third most affordable destination for saving towards a single-family home on a median post-tax income. Securing a single-family home in New Brunswick’s capital requires just three years and four months of saving on the median income.

Meanwhile, both Edmonton and Saskatoon require just under five years of savings for a down payment. Edmonton offers a median salary of $80,000 and average home prices 40% below the national average, providing ample opportunities for homeownership.

Five to Ten Years Savings Timeline

In Winnipeg, purchasing a home remains 43% less expensive than the national average, requiring a down payment of $18,651. Despite this, it takes over four years of diligent saving to accumulate the necessary funds.

Calgary, with its median post-tax salary exceeding the national benchmark by 19%, still requires six years and two months of saving for a down payment. However, the city's homes remain 12% more affordable than the national average.

London and St. Thomas present an eight-year saving timeline for a down payment on a single-family home, but with prices 8% below the national average, the investment may be worth it for many.

Ontario and British Columbia: Lengthy Saving Timelines

In Ontario's Hamilton-Burlington region, it takes over 12 years to save a minimum down payment of $57,055. Meanwhile, Greater Toronto presents a daunting prospect, with a saving timeline of 39 years for a down payment of $205,341.

British Columbia stands out as the most expensive province, with markets such as the Fraser Valley requiring 41 years and eight months to save a minimum down payment of $201,936. Greater Vancouver presents the most prolonged saving timeline, taking a whopping 50 years and six months for a significant down payment of $250,980.

Strategic Approaches for Savings

While these saving timelines may seem daunting, there are strategic approaches for prospective homeowners. Exploring opportunities in smaller cities, away from bustling downtown cores, can offer more affordable options. Additionally, pooling resources with family or friends or considering condos or attached townhomes can expedite the saving process.