Hopeful homebuyers may find relief knowing that the national average home priced dropped for the third month in a row in September.

In September, the national average home price dipped from $750,100 in August to $741,400. This welcome dip offers some respite to homebuyers contending with challenging borrowing conditions.

What's more, major real estate markets like Edmonton, the Greater Toronto Area, Montreal CMA, and Greater Vancouver are also experiencing a cooling off period, with September seeing a month-over-month decline in prices, according to the Canadian Real Estate Association (CREA).

For aspiring homeowners, this trend signifies a window of opportunity. While many sought-after markets continue to flirt with benchmark prices near or above $1,000,000, there are hidden gems in Canada's most affordable cities, where benchmark prices remain comfortably below $500,000.

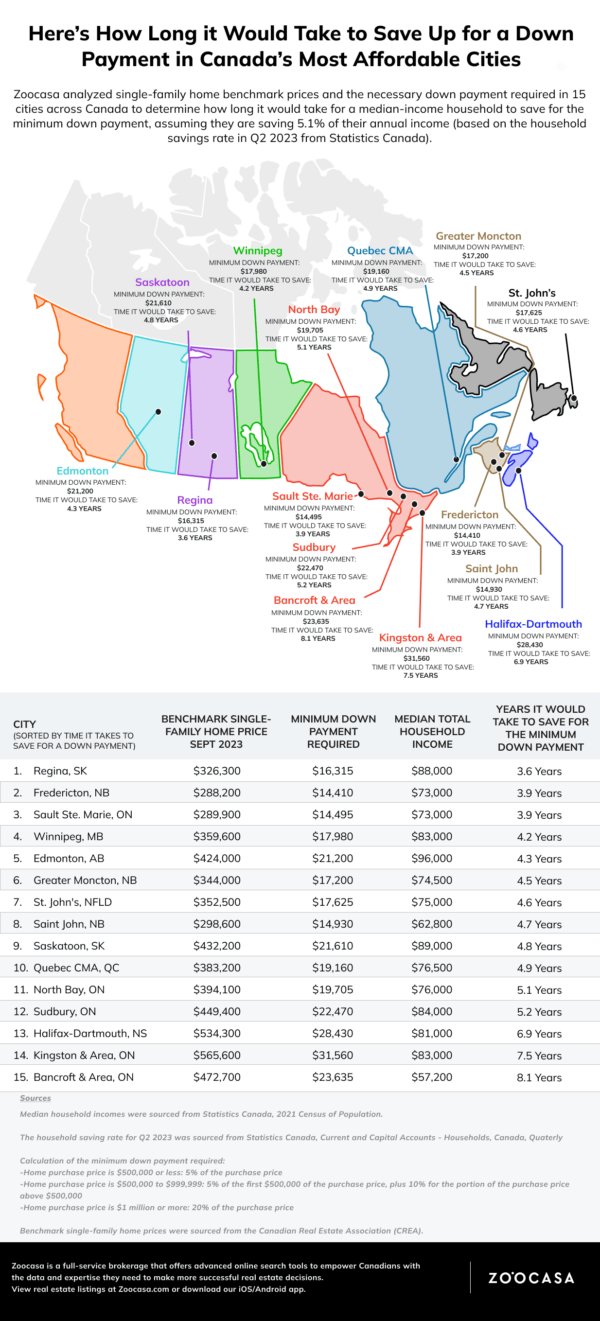

To help you gauge just how long it might take for a median-income household to save up for that elusive down payment, Zoocasa has undertaken an analysis of single-family home benchmark prices in 15 of the most affordable cities across Canada. Using data from CREA's September 2023 monthly report, Zoocasa considered the benchmark prices, median total household income, and the savings rate for each city, assuming a 5.1% annual income savings rate (sourced from Statistics Canada for Q2 2023).

Five Years or Less: The Majority of Cities

Regina emerges as the city where saving for a single-family home down payment is quickest, requiring just 3.6 years of dedicated savings. Although Regina's single-family home prices averaged $326,300 in September 2023, it boasts one of the highest median household incomes among the cities analyzed, standing at $88,000. This high income level provides Regina's homebuyers with a considerable advantage over other cities with lower benchmark prices and median household incomes.

Fredericton and Sault Ste. Marie share a median household income of $73,000 and nearly identical benchmark single-family home prices. In these cities, it would take only 3.9 years to save for the minimum down payment, which amounts to $14,410 in Fredericton and $14,495 in Sault Ste. Marie. Given their affordable housing prices, it's no surprise that these cities offer a shorter path to homeownership.

Ontario Cities: A Different Story

With the exception of Sault Ste. Marie, the four other Ontario cities on our list require more than five years to save for the minimum down payment. North Bay and Sudbury offer the shortest saving periods, with 5.1 years and 5.2 years, respectively. Sudbury enjoys a higher median household income but also has a higher benchmark price for a single-family home. In contrast, North Bay's more affordable housing prices make saving slightly easier.

Halifax-Dartmouth emerges as the second most expensive city on the list, demanding 6.9 years to save for the minimum down payment of $28,430 – over $10,000 more than the most affordable cities. Kingston & Area claims the title of the most expensive city on the list, with a benchmark price for a single-family home at $565,600 in September 2023. While the median household income is relatively high at $83,000, it would take 7.5 years to save for the minimum down payment of $31,560.

Bancroft & Area, characterized by country land and small towns, has the lowest median household income on our list at $57,200, which translates to the longest saving time. Here, homebuyers would need 8.1 years to save up the $23,635 required for a down payment on a benchmark single-family home valued at $472,700.

For those eyeing their dream homes in Canada's most affordable cities, the path to homeownership is attainable within five years or less in many cases. However, in some regions, particularly in Ontario, the journey to save for that down payment may demand a bit more time and determination.

Homebuyers should keep in mind that as home prices fluctuate and typically increase over time, the exact number of years required to save for a down payment may be longer than the time it takes to buy a home at the September 2023 benchmark.

Click here to read the full report.