In a turn of events that challenges traditional notions of real estate investment, new data from a recent report unveils a sobering reality for homeowners across Canadian cities, but particularly Burlington, where home values have experienced a significant downturn over the past year.

The report from Point2Homes, which scrutinized trends in condo and single-family home prices throughout Canada's major urban centres in 2022 and 2023, highlights a widespread devaluation of residential properties. It marks a departure from the conventional wisdom that real estate stands as a stalwart investment option.

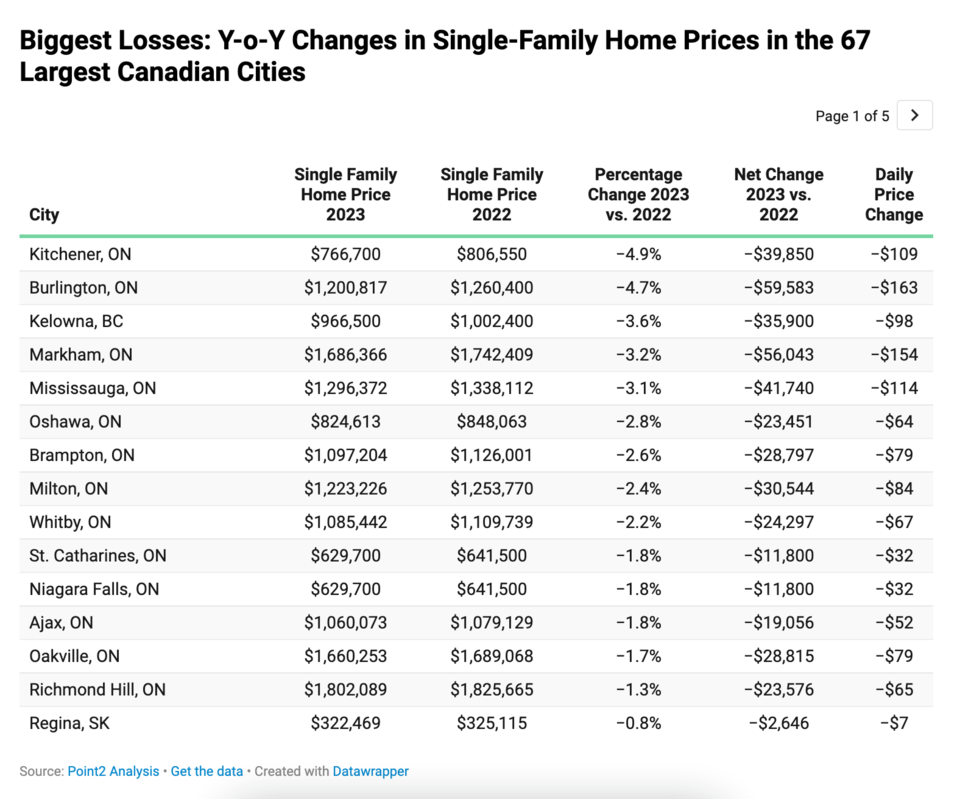

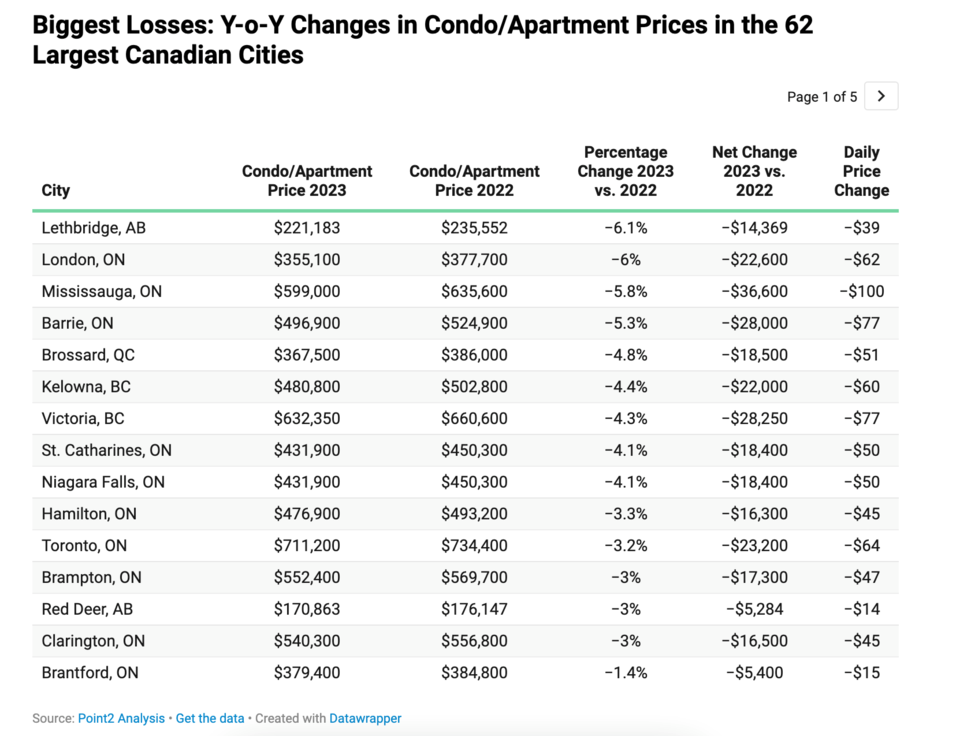

The year-over-year changes in home prices in the 67 largest cities in the country show that owners of single family homes in 18 cities and condo owners in 26 cities have seen their homes lose value in the last year.

So, where in Canada’s largest cities are new homeowners most regretting their decision to buy?

Burlington, Ontario emerges as the epicentre of this downward trend, earning the dubious distinction as the "worst-case scenario" for homebuyers. Those who purchased single-family homes in Burlington at the close of 2022 have experienced staggering losses, amounting to $163 per day—a cumulative depreciation nearing $60,000 from their original purchase price.

The plight of homeowners extends beyond Burlington, echoing throughout Ontario's housing landscape. In Markham, buyers incurred losses averaging $154 daily, translating to a yearlong depletion of $56,043 in property value.

Similarly, purchasers in Mississauga faced daily depreciation of $114, totalling $41,740 over the course of the year. Meanwhile, those in Kitchener weathered losses amounting to $109 per day, culminating in a deficit of $39,850 by year's end.

"Falling home prices may make many new owners regret their decision to finally take the plunge and buy a home a year before, when prices were still at all-time highs. Homeowners across the country are feeling the sting of their homes losing value and are contemplating a distressing reality: Their hard-bought homes are currently worth less than one year ago," reads the report.

You can view all the findings here.

Condominium owners have not been spared from the market's downturn, with Mississauga again at the forefront of loss. The value of condos in the city plummeted by $36,600 over the course of the year, marking a daily decline of $100—a trend mirrored across 26 markets nationwide.

The report highlights a disconcerting reality where condo owners, in particular, find themselves on the losing end of the market correction. What was once deemed a more affordable housing option has experienced a generalized decline in value, dashing hopes of equity growth for many owners.

Notably, Lethbridge, Alberta; London, Ontario; and Mississauga, Ontario, experienced the most significant percentage decreases, with drops of 6.1%, 6%, and 5.8%, respectively. Meanwhile, the most substantial net losses were recorded in Barrie, Ontario; Victoria, British Columbia; and Mississauga, Ontario, where homeowners faced daily losses ranging from $77 to $100, accumulating to substantial deficits over the year.

You can view the full findings here.

The report's stark findings prompt reflection among homeowners nationwide, as they grapple with the unsettling reality of diminished property values. The allure of homeownership, once synonymous with financial security, now confronts the harsh reality of depreciating assets, prompting a sobering reassessment of investment strategies.

As falling home prices reverberate across Canada's largest markets, homeowners find themselves navigating uncertain terrain, grappling with the disconcerting realization that their prized investments are now worth less than a year prior.