When it comes to becoming a homeowner, purchasing a house when you're single can feel overwhelming, especially in Canada where housing prices tend to soar.

Complicating matters further, homeownership rates continue to rise while wages remain stagnant. However, an intriguing trend has emerged—the number of individuals buying properties with partners or spouses has steadily declined. This shift highlights that joint incomes are not the sole ticket to homeownership and that financial independence is within reach for anyone venturing into the realm of home buying.

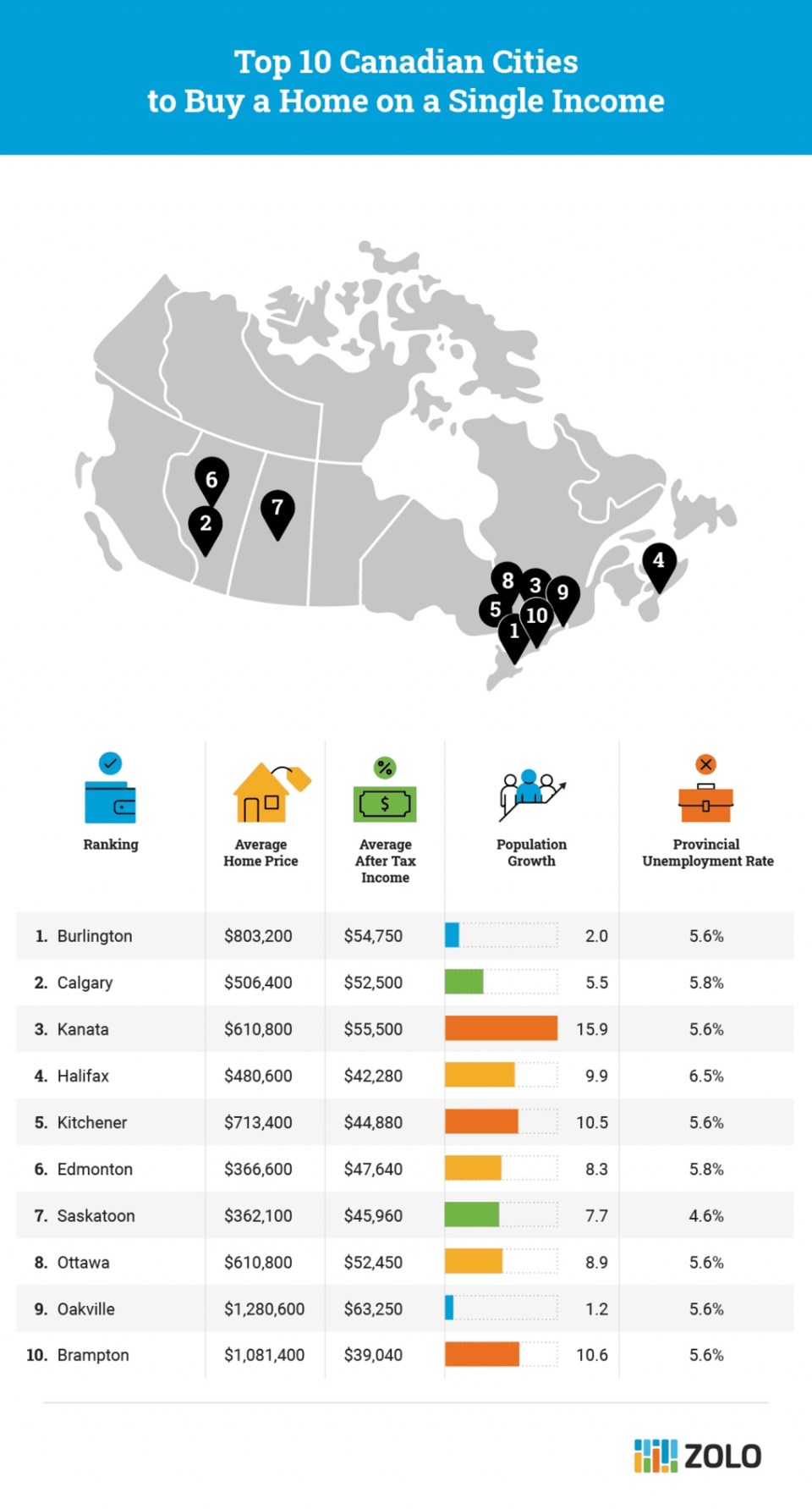

To empower single buyers in their quest for independent homeownership, Zolo evaluated and ranked the top Canadian cities for purchasing a home as a single person.

Zolo's analysis encompassed several key factors, including average housing prices, number of one-person households, after-tax income, unemployment rates, and population growth rates. By considering these metrics, Zolo identified the most favourable cities for single homebuyers.

Zolo also recognized that most single buyers are not seeking traditional detached homes and to provide a comprehensive perspective, average prices for apartments and townhomes in the top Canadian cities for singles were also included.

Zolo's assessment involved comparing average home prices among the 25 most populous areas in Canada, focusing on cities with a population of 100,000 or more. Zolo then delved into supportive data, aiming to gauge both the affordability of homes for individuals and the overall viability of single households in each city.

Factors such as single population demographics, employment opportunities, and population growth were taken into account, shedding light on the most favourable locations for single home buyers.

The Changing Landscape of Single Homeownership

The Changing Landscape of Single Homeownership

What prompts so many individuals to pursue independent living and property ownership? Several factors contribute to this evolving landscape. According to the report, there's been a significant shift observed in the delay of having children and a rising number of divorces among singles in Canada. Many individuals choose to become parents at a later age or have already experienced separation within common-law partnerships. Additionally, nearly half of solo dwellers aged 35 to 64 have gone through a divorce or separation within the last two decades.

Another influential factor stems from a more flexible attitude toward family structures. Statistics Canada's report reveals a changing societal outlook, as fewer singles consider marriage as a defining aspect of adulthood. This shift is particularly prominent among young people pursuing higher education. The study further highlights a correlation between higher education, delayed marriage, and the decision to start families later in life.

These evolving trends have undoubtedly impacted the housing market, leading to a surge in solo dwellers seeking condominiums—a more attainable option for those purchasing a home on a single income. Condominiums align with the growing demand for individual living spaces, providing an accessible entry point into the real estate market.

The 5 Best Places in Canada for Single Home Buyers

- Burlington, ON

- Average home cost: $803,200

- Average apartment cost: $549,900

- Average townhome cost: $664,500

- Calgary, AB:

- Average home cost: $506,400

- Average apartment cost: $286,200

- Average townhome cost: $388,200

- Kanata, ON:

- Average home cost: $610,800

- Average apartment cost: $413,900

- Average townhome cost: $464,800

- Halifax, NS:

- Average home cost: $480,600

- Average apartment cost: $428,100

- Average townhome cost: $482,400

- Kitchener, ON

- Average home cost: $713,400

- Average apartment cost: $472,000

- Average townhome cost: $594,200

Mastering the Art of Single-Income Home Buying

Approaching the real estate market on a single income can present challenges for many individuals. However, armed with the right knowledge, savvy single home buyers can overcome these obstacles. According to Zolo, here are three key tips to enhance your negotiating skills and secure the best price when venturing into the home buying process:

-

Turn Up the Pressure: Leverage emotions to your advantage. Craft a solid, formal offer with a tight deadline in a competitive market. Instead of providing a reasonable time-frame for the seller to consider your offer, limit their response time to a few hours, compelling them to make a swift decision.

-

Bait and Switch: Employ this tactic in less competitive markets. Begin with lower offers and gradually increase your bids closer to the seller's expected sale price. This strategy can psychologically influence the seller to accept a lower offer.

-

Offer More, Ask More: In highly competitive markets, consider the overall cost of buying a property, including factors beyond the purchase price. Take into account closing costs, property transfer taxes, and other expenses. Assess the broader financial implications to maximize your purchasing power.

While the reality of buying a home on a single income may present challenges, it is far from impossible. By diligently saving for a solid down payment of at least 10% and maintaining a manageable debt load, single homebuyers can turn their dreams of independent homeownership into a tangible reality. Numerous major and smaller cities across Canada offer promising opportunities for those venturing into the real estate market alone.