As Canadians continue to grapple with high inflation and steep home prices and borrowing costs, some buyers are faced with limited purchasing power, which has undoubtedly put their dreams of homeownership on hold.

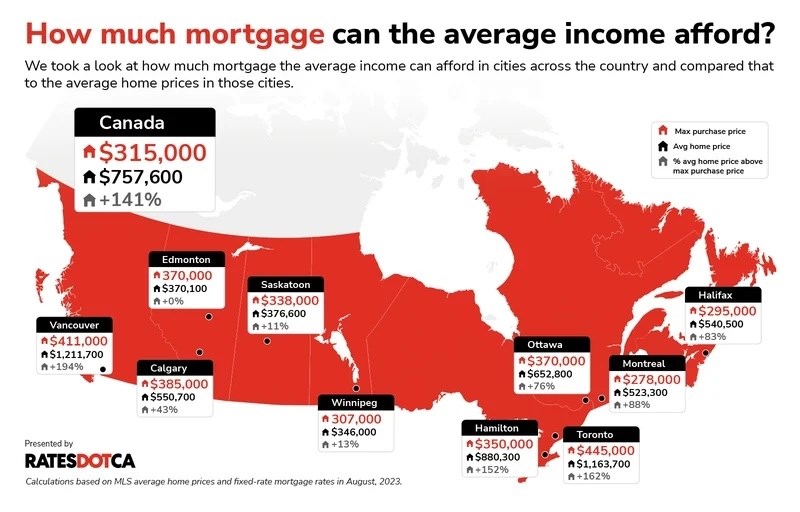

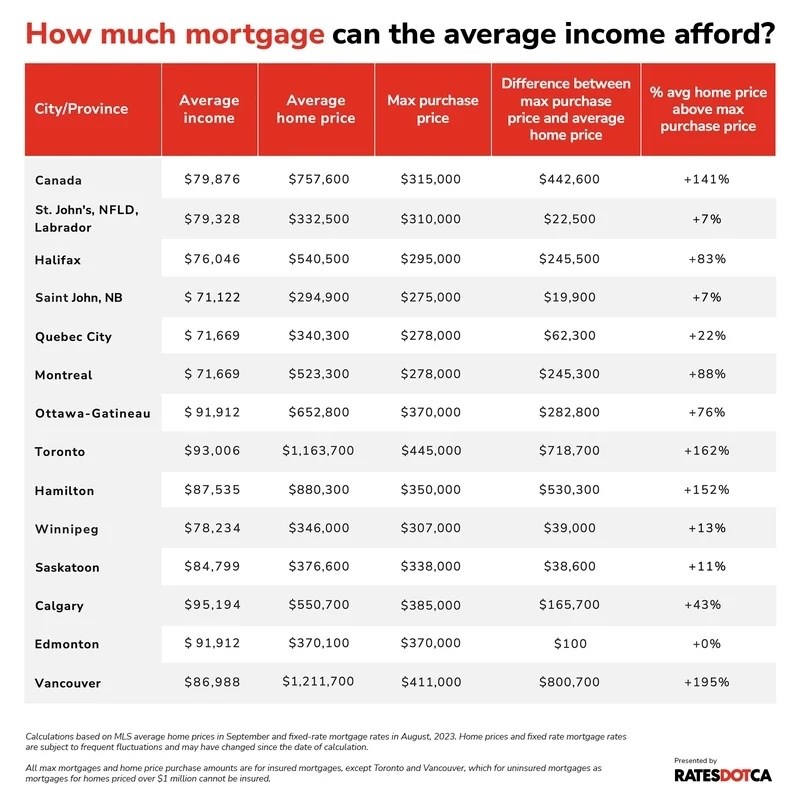

While affordability concerns force some hopeful buyers to the sidelines to wait for interest rates and housing prices to stabilize, a new report from RATESDOTCA revealed just how much mortgage the median household income can afford in ten major Canadian cities.

To determine this, RATESDOTCA calculated the median after tax household income and the mortgage amount a family could qualify for and compared these figures with the average home price in each city.

Across the nation, a typical Canadian household earning the median income of $79,876 has the capacity to purchase a home valued at $315,000, supported by a maximum insured mortgage of $299,500. However, with the average home price in Canada now sitting at $757,600, the average home carries a price tag that surpasses this family's means by 141%, commonly referred to as the maximum purchase threshold.

When dissecting this data on a city-by-city basis, it becomes evident that homeownership is not merely a financial stretch but rather a considerable challenge. In cities such as Vancouver and Toronto, the cost of owning a home exceeds the financial reach of the average family by nearly 250% and 210%, respectively, when gauged against the median income.

Here's how Canadian cities rank based on most to least affordable:

According to RATESDOTCA, buyers won't have to worry about stretching themselves too thin in Edmonton, as the average home price is just enough for someone to afford a home. Here, a typical household earning the median income of $91,912 has the capacity to purchase a home valued at $370,000, supported by a maximum insured mortgage of $351,500. With the average home price sitting at $370,100, the cost is 0% above the household's max purchase price.

On the other side of the spectrum, the average home price is 249% more than what the average household can afford in Vancouver—yikes. And since the average home price is over $1 million, RATESDOTCA included the uninsured mortgage amount, which is 195% more than what the average household can afford.

While rising demand and limited housing supply are driving unaffordability, RATESDOTCA says increasing the supply of homes is challenging as construction financing is more difficult due to higher interest rates.

However, to cool parts of Canada's housing market, several initiatives are already in place. Ontario's government has introduced housing reforms and promises increased construction. The City of Toronto has committed $8 billion to expedite development, opening 7,500 affordable homes and 40,000 rental units. The Federal government has also pledged $4 billion for a Housing Accelerator Fund to combat housing shortages.

To learn more about the findings of this report, click here.