This year, interest rates in Canada have remained high, leaving homebuyers and sellers uncertain about the housing market's future.

With two more Bank of Canada announcements scheduled later in the year, the housing market is navigating uncharted waters. However, this period of hesitancy has led to a notable increase in inventory, particularly in the Greater Toronto Area (GTA), and a more balanced market. As a result, home price growth has begun to slow down.

While prices have come down significantly from their peak in 2022, affordability remains a pressing concern for many Canadians, especially those residing in the country's most expensive provinces. According to data from the Canadian Real Estate Association (CREA), the average home price in Ontario in August 2023 stood at $908,000. Although this marked a 2.1% decrease from June 2023, when prices hit their highest point of the year, it still presents a formidable barrier to the average Ontarian aspiring to own a home.

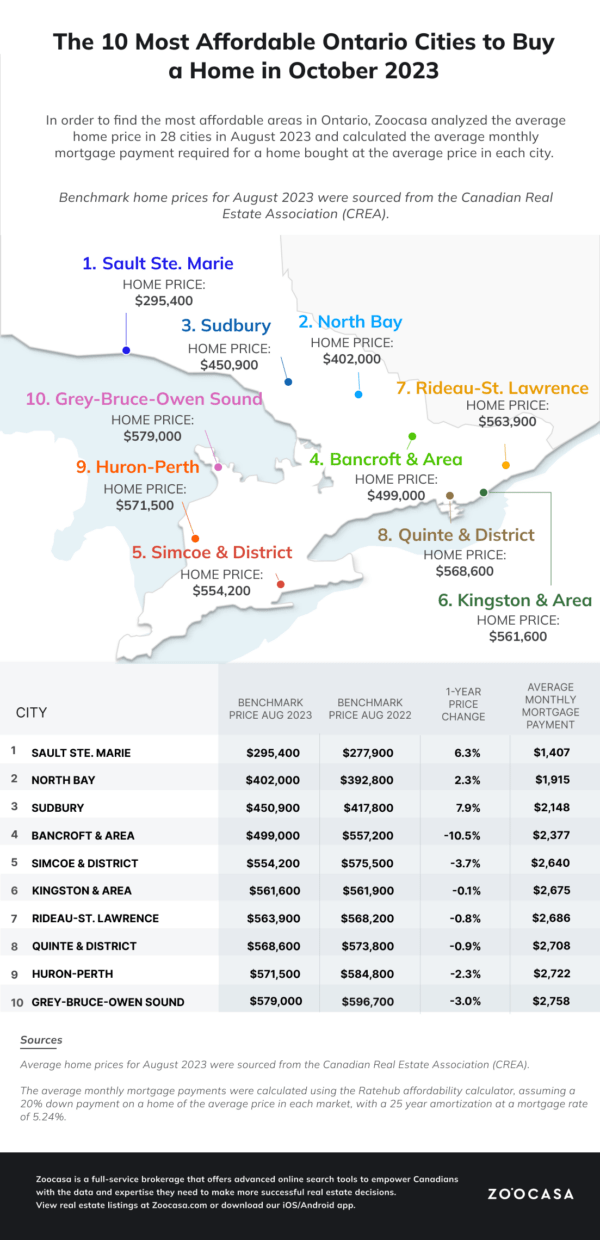

In an effort to shed light on where affordability still exists in Ontario, Zoocasa conducted an analysis of the average home prices in 28 cities across the province in August 2023. They also calculated the average monthly mortgage payment required to buy a home at the average price in each of these cities.

Affordable Homes Abound Beyond Central Ontario

For homebuyers willing to cast their nets outside of the GTA, a treasure trove of affordable cities awaits, with homes priced under $600,000. In fact, the top four most affordable cities—Sault Ste. Marie, North Bay, Sudbury, and Bancroft & Area—all boast benchmark prices below $500,000. Remarkably, these top four remain unchanged from the previous report, although Simcoe & District has managed to climb into the fifth spot, displacing Kingston & Area to sixth place.

Topping the list of affordability is Sault Ste. Marie, where the benchmark price in August 2023 was $295,400, resulting in an average monthly mortgage payment of $1,407. It's worth noting that in the previous report, conducted in July 2023 using May 2023 data, the average monthly mortgage payment in Sault Ste. Marie was $1,330. The increase in monthly mortgage payments can be partly attributed to the benchmark price's rise of nearly $8,000 from May, while higher mortgage rates have also played a role in this change.

Notably, Bancroft & Area experienced the most significant one-year price drop, with a 10.5% decrease from $557,200 in August 2022 to $499,000 in August 2023. Another city that saw a substantial price drop from 2022 was Simcoe & District, which witnessed a 3.7% decrease from $575,500 in 2022 to $554,200 in 2023.

There are also some new additions to the list of most affordable cities, including Rideau-St. Lawrence, Quinte & District, Huron-Perth, and Grey-Bruce-Owen Sound, in that order. All four regions offer benchmark prices ranging between $560,000 and $580,000, with average monthly mortgage payments falling between $2,685 and $2,760.

Impact of Higher Interest Rates on Affordability

Interest rates have played a significant role in shaping affordability in 2023. In May, the average discounted 5-year fixed mortgage rate stood at 4.29%, but it has since risen to 5.49%. Furthermore, the Bank of Canada's overnight lending rate was lower in the spring, at 4.5% in May, but has now reached 5.0% since July, with the possibility of further increases.

As a result of these higher interest rates, some cities with lower benchmark prices from May have seen an increase in monthly mortgage payments. For instance, in North Bay, the second most affordable city, the benchmark price decreased from $409,300 in May to $402,000. Despite this price dip, the average monthly mortgage payment increased from $1,893 to $1,915.

Sudbury, the third most affordable city, followed a similar trend. The benchmark price in May was $451,000, with an average monthly mortgage payment of $2,086. In August, while the benchmark price dipped slightly to $450,900, the average monthly mortgage payment increased to $2,148.

In summary, as interest rates continue to fluctuate, affordable housing opportunities still exist in Ontario, particularly in cities outside of the GTA. The real estate market may be uncertain, but these affordable options offer hope to homebuyers looking to make their homeownership dreams a reality.